The Trusted Adviser

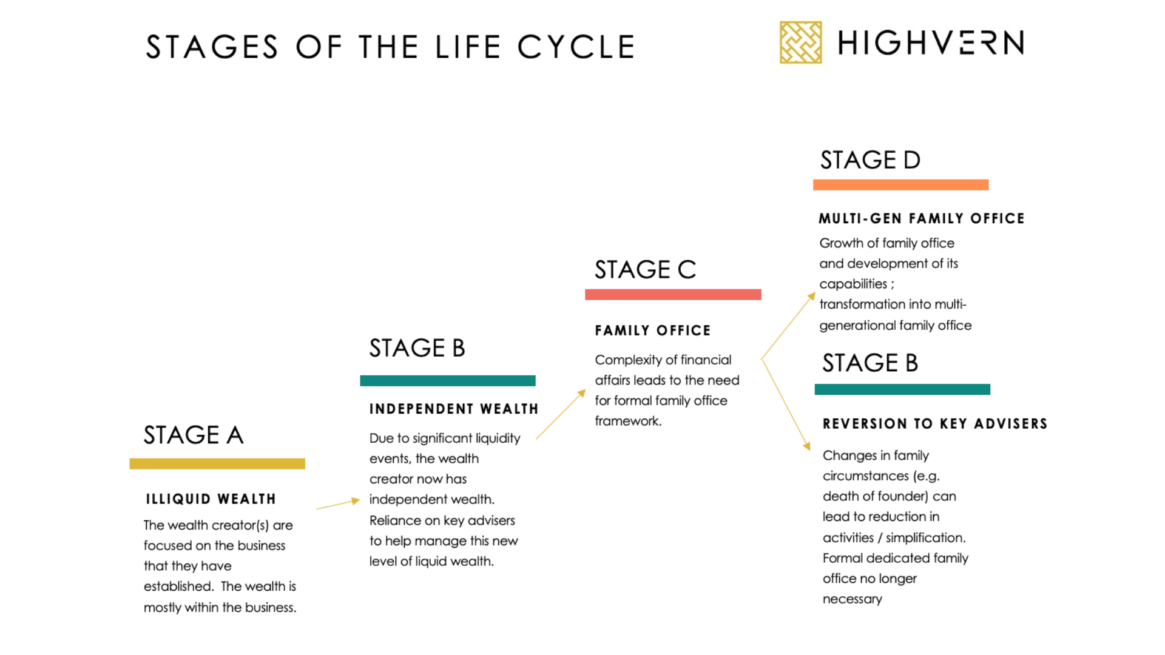

One such adviser who might be approached first is the family businesses CFO, or a family layer, someone who is trusted and who has served the family or financial affairs over a long period of time. Then, as matters become more complex the adviser themselves can recognise that external skills and abilities are required outside of their remit, and they will seek to create a financial support system more like an organisation.

Planning the family office framework

Once the decision to expand from the Trusted Adviser arrangement to a family office organisation has been made, there is a key initial decision to be made. This is whether the framework for a formal family office is going to evolve “by chance” or “by design”. Most professional advisers to the family will stress the benefits that full planning can bring, but for many, the cost, flexibility, and opportunity that comes from a less structured approach can be valid. In my experience, around 50% of family office organisations evolve by chance, since employees are brought on to fill designated tasks, reactively responding to the changing tasks generated by the family’s personal and investment activities. Alternatively, a family office framework which has been fully mapped out in advance does bring a certain amount of strategic clarity. Through this process, core issues are fully thought through and a vision established before seeking personnel, choosing the optimal location and the organisational design.

The family may have wealth structures (Trusts, Foundations etc) which may pre-date the family office evolution or the necessity for such structures may develop during the planning process. In either route it may be that the trustee or service provider becomes an integral part of the family office and may even provide the headquarters for operations.

Managing change and new generations

No matter how sophisticated a family office is, at some point there will come a need for a decision to be taken by the family office founder for change. A decline in wealth levels, changes in circumstances (death, divorce, incapacity) or a family dispute can all impact the operations of a family office and the organisation may need to be adapted accordingly. Single Family Offices (SFOs) and Multi Family Offices (MFOs) have been known to be disbanded due to poor investment performance.

Even successful structures will need to evolve depending on whether the next generation will be willing to support the organisation and provide it with a mandate to continue managing the family’s affairs. If the family choose to go down this path of creating a multi-generational family office, it has to be recognized that the organisation now has multiple stakeholders. At this juncture I believe it is crucial to have a design in mind rather than continuing by chance to ensure you demonstrate the principles of good governance and fairness to all family members involved. Different stakeholders will have different expectations and needs and will want to be involved to a greater or lesser extent in the ongoing management. Board composition and family influence will require careful thought.

However, should the family office framework become disbanded for whatever reason it is likely the family will then revert to relying on one or more key trusted advisers instead, therefore bringing the life cycle of a family office full circle.

There are multiple factors at play which influence the above cycle, particularly in times of increasing change and uncertainty. The recent turbulence and political uncertainty arising from the COVID-19 pandemic, along with increased working from home patterns has led to an increase in planning for ‘virtual family offices’, where premises and choice of location are irrelevant. The rise in the use of cryptocurrencies brings an increasing emphasis on security and control creates an additional reason for families to create family office organisations. The desire to create longevity of wealth, coupled with the need to adopt modern governance and transparency principles, will always factor into a family’s need for support from professionals, whatever stage of the life cycle they are in.